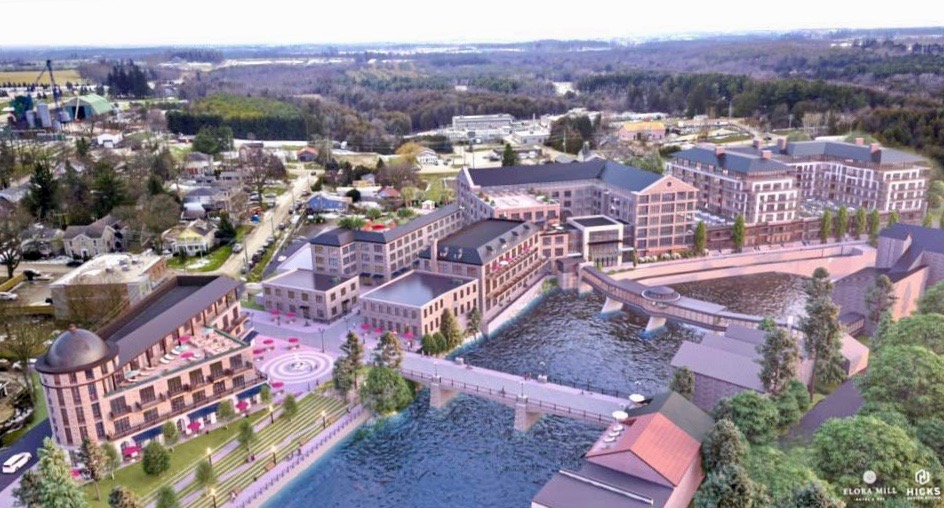

ELORA – Pearle Hospitality will get a 10-year tax break on its Elora south development after council agreed on July 26 that it qualifies for a Tax Increment Equivalent Grant (TIEG).

“This property is ideal for a TIEG,” said councillor Kirk McElwain, dismissing concerns the public doesn’t know what exactly will be built after the company submitted and then withdrew a zoning amendment application to add an extra storey to two of the buildings in the plan.

“If nothing is developed, we don’t pay. I don’t see any logical reason why we would not approve this.”

Council approved the TIEG concept in 2010 as an incentive for builders to take on tricky projects that would improve business opportunities and increase the tax base in Centre Wellington.

Properties that qualify for a TIEG must meet one or more of the following criteria:

- frontage along the Grand River;

- a building on the site has significant heritage value;

- the site is vacant or underutilized with potential for significant development; and

- the site is subject to a proposal that will help achieve growth targets under the provincial growth plan.

In 2015 council deemed Elora south a priority project.

Under the TIEG, Pearle would pay its taxes and then receive a rebate for a portion of the bill.

“A TIEG is calculated as a portion of the municipal property taxation increase due to the ‘substantial’ development, redevelopment, or rehabilitation of an eligible building or property,” states the report to council.

“The increase in property taxation, or ‘tax increment,’ is calculated by subtracting the municipal portion of property taxes before development from the municipal portion of the property taxes after development.”

The report notes the site is currently assessed at $2 million and that will increase to $130 million when the project is complete.

That equates to an additional $475,000 in annual taxes for the township and more than $900,000 for Wellington County.

And even while the TIEG is being paid out, the township will still receive more in taxes that it did from the undeveloped site.

Pearle president Aaron Ciancone said the tax grant would help with the cost of cleaning the contaminated site, providing dedicated public space and preserving historical features like the Potter’s foundry, which was taken down, moved and painstakingly reassembled for public use.

Resident Vince Agostino spoke against approving the grant, calling it “speculative” and “premature” given the zoning amendment change Pearle proposed just a few weeks ago.

“You are asking taxpayers to subsidize luxury apartments,” he said. “Why should we subsidize this development?

“We are pro appropriate development and affordable housing. You are forcing this on citizens, but we are seeing through it.”

“I think this is not a site that’s hurting for money,” councillor Stephan Kitras agreed.

“It has vast potential. We need more information before we give another free lunch.”

Councillor Bob Foster said he doesn’t think a TIEG should be granted until the project reaches the site plan stage. He put forward a motion to defer the decision, but his motion was defeated.

Councillor Neil Dunsmore said the TIEG policy applies no matter who the developer is, “and to change it because it’s Pearle Hospitality – that’s nasty.”

He added, “We need to be honest and ethical whether we like the developer or not.”

Councillor Ian MacRae said, “The developer is doing all that we requested with that site. Taxpayers will get tremendous value for this TIEG.”

Managing director of corporate services Dan Wilson noted this is not a tax subsidy but a rebate – and no part of it comes from the taxpaying public.

“It checks all the boxes for me,” said Mayor Kelly Linton.

The motion passed with Foster opposed, Kitras abstaining (which counts as a no), and the mayor and remaining councillors voting in favour.

The township and Pearle will have to sign an agreement with Wellington County to officially put the TIEG agreement into action.