MAPLETON – A Cost of Community Services Study conducted for Mapleton by the Ontario Federation of Agriculture (OFA) shows farm and forest lands generate substantially more revenue for the municipality than it costs to service them.

The study’s authors say the results also help make the case for rethinking the way municipalities are funded across the province.

In July of 2021, Mapleton council approved the township’s participation in the study, which provides a “snapshot” of demand for municipal services by property type in 2019.

The results were presented at the March 8 council meeting by OFA senior farm policy analyst Ben Lefort and Wellington Federation of Agriculture (WFA) president Janet Harrop.

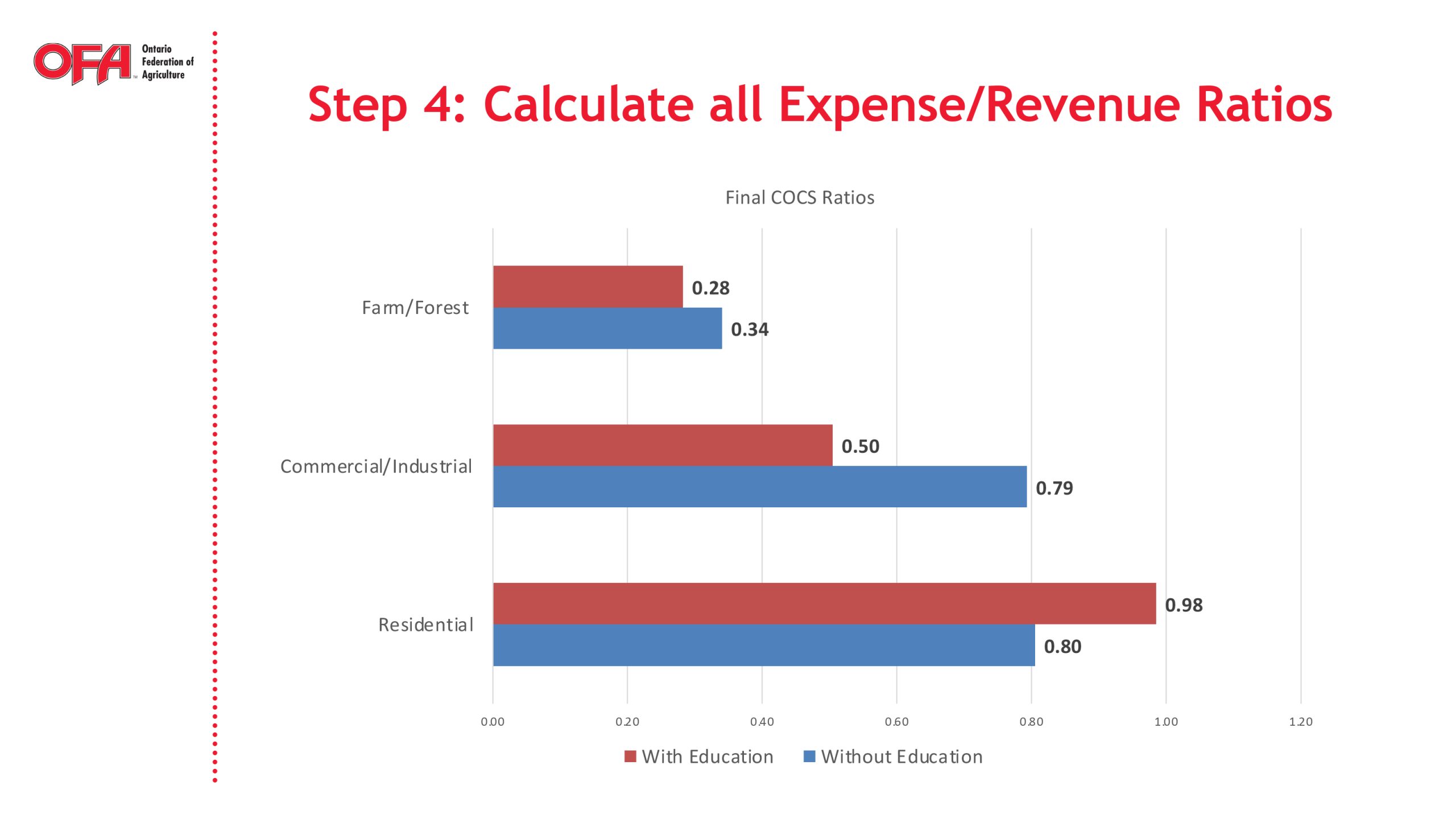

The study shows the township spends 34 cents on services for land in the farmland/forest class for every dollar it collects in taxes from such land.

By comparison, the study shows municipal spending of 80 cents for every dollar collected from the residential class and 79 cents per dollar of commercial taxation.

The numbers shift to varying degrees when education taxes are factored into the mix.

When education taxes are included, the expense/revenue rate for farmland falls to 28 cents, compared to 50 cents for commercial and 98 cents for residential.

However, Lefort cautions, the inclusion of education taxes can confuse the issue.

“It’s kind of an awkward bit in this whole situation, because municipalities, lower-tier ones, are involved in collecting and remitting the educational property tax, but especially not involved in delivering it (education),” he noted.

Lefort stressed the study used 2019 numbers and should be considered a “snapshot in time.”

“It’s not necessarily a predictive result. It is a case study,” he pointed out.

Lefort noted the fact residential land in the study has a service to expense ratio of 0.8, may not translate to future development.

“That doesn’t necessarily mean if you build one more residential unit, that the residential units only consume 80 cents worth of services,” he explained.

“For every dollar of revenue brought in, it depends entirely on what type of residential unit it is, where it’s located and what kind of services already exist there.”

While the results are in line with numerous reports completed in the United States, Lefort said more case studies in different municipalities throughout the province will be needed to gather more data.

While municipalities are asked to provide a number of different services, Lefort pointed out they are only given one form of taxation they can control: property taxes.

He said that raises a number of policy issues in regard to the municipal/provincial relationship.

Lefort said the Ontario government should address a historic inequity in provincial gas tax funding as well as:

- promptly deliver updated property assessment (due to the pandemic MPAC assessments remain frozen at 2016 levels);

- increase the Ontario Municipal Partnership Fund (OMPF) by 75% to provide the same level of support the program did in 2005; and

- consider fully uploading education property taxes.

“The provincial gas tax funding is … essentially based on your transit. How much public transit do you have in your municipality? You don’t have public transit, essentially, (so you) do not get any money,” Lefort told council.

“And that effectively excludes many rural municipalities from funding … on the gas tax at the provincial level.”

Lefort added that’s not the case with the federal gas tax, which is provided to municipalities to be spent on a wide range of infrastructure.

Mapleton received about $638,000 in federal gas tax money in 2019. Had the province used the same allocation formula it would have sent the township about $145,000 in 2019.

“That’s not massive … but that is two per cent of your tax levy. So it’s not insignificant either,” Lefort stated.

“I see that as a low hanging fruit issue. I’m going to stop and get some gas my way home, I’m going to pay tax on it and that’s going to go from Mapleton to urban areas that have the transit, right? So there is an air of inequity.”

Because the province was set to update property assessments prior to the pandemic, subsequent decisions to put off reassessment until 2024 mean municipalities are working with increasingly dated information when formulating tax rates.

“I’m not sure locally what the property values have done last couple years, but if they are like many other places it’s going to be quite a sticker shock for many folks when we finally do get a new assessment,” he pointed out.

Lefort said years of reductions to OMPF funding have left municipalities trying to keep up with increasing service demands despite a decreasing pool of support funding.

In Mapleton’s case, he said the municipality received $1.2 million in 2005, which, if simply adjusted annually for inflation would have meant the municipality would have received $1.6 million in 2019.

Instead, Mapleton’s actual 2019 OMPF allocation was $837,000.

“So essentially, adjusted for inflation, your support through the OMPF, has been cut in half from 2005 to 2019. And, as everyone in this room is aware, that is a key funding program for rural municipalities,” Lefort pointed out.

“And this is a much bigger item. This is around eight and a half percent of the tax levy. So this is a big, big number,” he added.

A recent Ontario Federation of Agriculture study shows Mapleton Township spends 34 cents on services for land in the farmland/forest class for every dollar it collects in taxes from such land. By comparison, the township spends 80 cents for every dollar collected from the residential class and 79 cents per dollar of commercial taxation. (OFA image)

While noting the question of education funding is “kind of academic” Lefort pointed out, “the more studies I do, the more ask the question, ‘Does it still make sense to have the very specific limited role of municipalities in the in the funding of education?’

“It is a province-wide service, dictated by the province, for benefit of all families in Ontario. Isn’t it something that should just be funded by the province outright?”

Mayor Gregg Davidson thanked the delegation for the insights the study provided.

The mayor said the gas tax inequity was a particular revelation to him.

“That needs to change. You can’t just be giving money out to the to the cities that have transit and then leave us rural people out, because we do need to keep our transportation going just like you do in the city,” said Davidson.

“We might not have the trains and the buses and all the rest, but we have people, vehicles, produce, tractors – we need to move a lot of items in our communities. And that means we need roads. So getting that provincial gas tax will be very important to us as well.”

Councillor Dennis Craven wondered if the farm organizations are seeking a reduction in the rate, currently 25% of the residential tax rate, charged for farmland.

“Are you suggesting that should be lowered quite a bit?” Craven asked.

“We have had that discussion at the county many times and there are neighbouring counties that have lowered that 25% tax ratio down as low to 21%, or 20%,” said Harrop, adding the 34 cents in services per tax dollar for farm properties would actually translate to about 10% of the residential rate.

“So we have talked to the county about that. There’s not an appetite, because there’s still … not the funding coming in at the federal, provincial level, and they’re trying to balance budgets,” she added.

“But the hope of doing this study was to show truly, at the municipal level, this is just the municipal level, it doesn’t bring the county piece into the equation, what it actually costs to deliver services.

“We’re just hoping that this study will show the relevance of agricultural land.”

Davidson noted the funding proposals suggested through the study could have an immediate impact for taxpayers

“We get this extra $800,000 (from OMPF), we get some gas tax from the province, we’re probably looking at a 10% cut to our property taxes right away,” the mayor pointed out.

“It would be very difficult to convince our urban residents that the farmers need to pay less taxes. And I say that as a farmer myself,” said councillor Marlene Ottens.

“But I wonder if the WFA would be interested in perhaps lobbying more for OMPF funding increases? … Is there some way we could lobby together?”

“We’d be more than happy to support any kind of work at the top governmental levels,” Harrop replied.

Council received the presentation as information, but Davidson said the municipality would get in touch with the farm organizations about working together on delegations to provincial officials at the Association of Municipalities of Ontario conference in August.

“They’ll be a new government in at that time, or it might be the same, I don’t know. But there will be some new people around the table that’s for sure,” Davidson stated.