ARTHUR – A will is a legal document that outlines a person’s wishes regarding how their property and assets will be distributed after their death.

Despite its importance, many people put off creating one until later in life, if ever.

Mary-Lou Fletcher, partner at Woods, Clemens, Fletcher and Cronin, which has offices in Drayton, Arthur, Elmira and Wellesley, has been practicing law for 23 years and is a firm believer in having a will prepared, regardless of age.

“It’s very important to have a will. Without one, the beneficiaries of your estate may be people that you did not necessarily want to benefit,” Fletcher explained.

“It’s a misconception that everything goes to the government if you die without a will. That is not true. Although if you die without a will, there could be some very unfortunate consequences of not having one.”

A recent Angus Reid Institute poll found that 51% of Canadians do not have a last will and testament, including one-in-five aged 55 or older.

Fletcher believes anyone over the age of 18 should have a will. If a person owns property, owns a vehicle, has a bank account or is considering having children – there should be a written will.

“In case I die in this mess I leave all to the wife – Cecil Geo Harris.”

These were the last words famously written by Cecil George Harris in June of 1948. Harris had been pinned under his tractor on a farm near Rosetown, Saskatchewan. In what ultimately would be his last moments on Earth, he used a pocketknife to inscribe the message into the tractor’s fender.

The case set a precedent for lawyers around the globe and is commonly used as an example in textbooks on wills and estates. Despite the tragic circumstances, Harris’ wishes were upheld by the courts. Unfortunately, this isn’t always the case when it comes to handwritten wills.

Fletcher told the Advertiser that an individual can write their own will, but it’s not recommended. This is called a holograph will and while legally binding, there are certain provisions that can be missed.

“It’s possible to create a homemade will if it’s in your own handwriting, signed and dated, but if it’s improperly witnessed, it can be null and void,” Fletcher said.

“Even if you’ve typed up and signed a will, it has to be properly witnessed by two separate witnesses that are not beneficiaries or spouses of the beneficiary.”

There are many reasons to have a professional prepare your will but having direction on what to put in the will is invaluable.

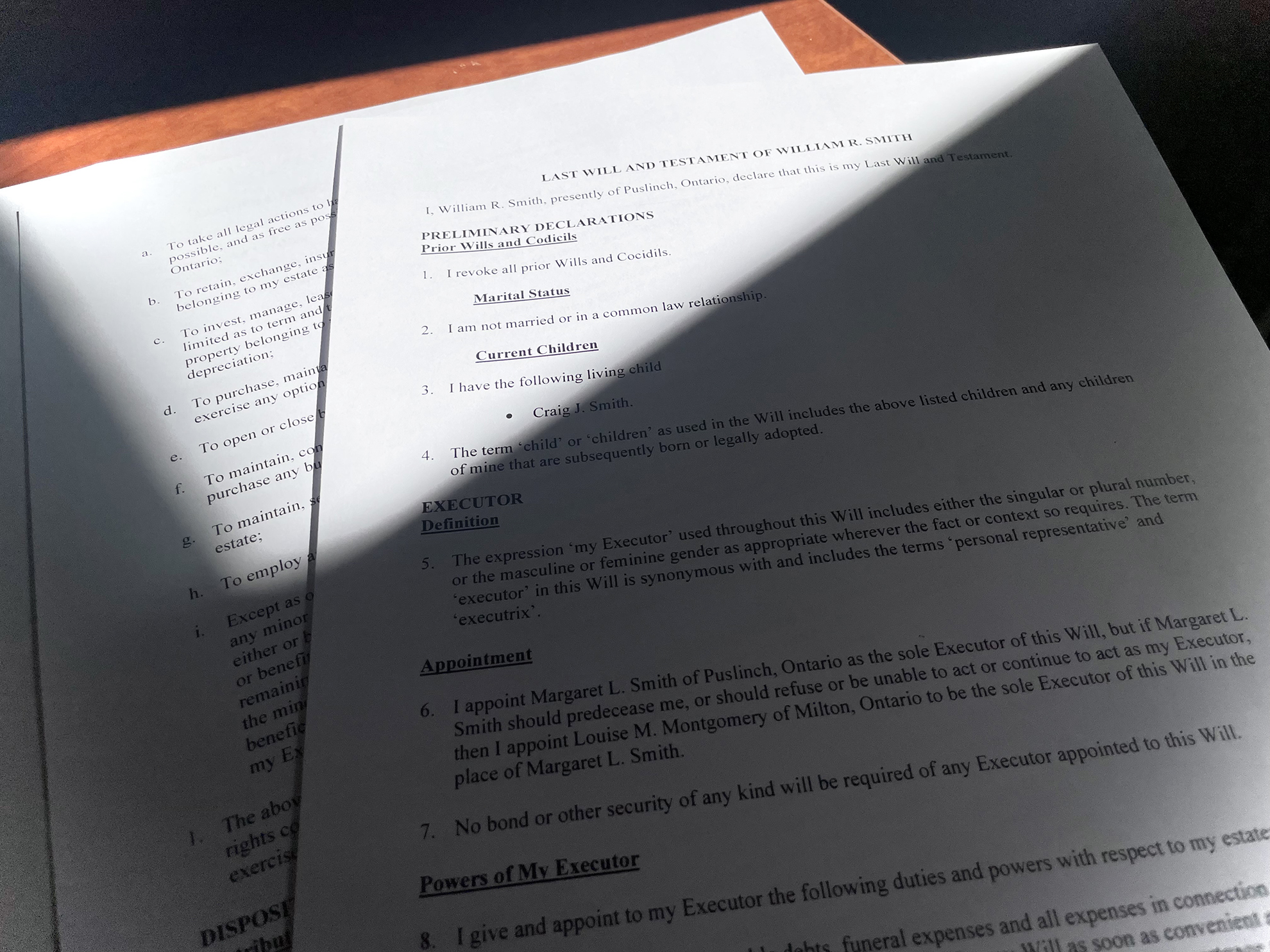

“The first thing to cover is who you want to be your estate trustee. We previously referred to this as your executor (or executrix, if it was female), but now we say your estate trustee – the person who handles all the administration for your estate,” Fletcher explained.

“Then you cover who you want the beneficiaries to be – who your money and assets to go to. Finally, who you want to be guardian of any young children you may have.”

While it’s common for people to create a will when they are first married and considering having children, determining when to update a will can often depend on circumstance.

Typically, changes are made later in life when estate trustees and beneficiaries get older.

A power of attorney is a separate document that is just as important as a will. The main difference is that it takes effect while a person is still living, but incapable of managing their own affairs.

A power of attorney for property appoints someone to make financial decisions whereas a power of attorney for personal care appoints someone to make medical decisions.

“A power of attorney for property is the more important of the two,” Fletcher said.

“If you’re in an accident and become incapacitated, but are still living, the government will intercede [if there’s no power of attorney in place]. The public guardian and trustee’s office will look after your assets and financial affairs and even your spouse is not able to step in.

“When you die, the power of attorney becomes null and void. It ceases to exist.”

The cost for a single will at Woods, Clemens, Fletcher and Cronin is $250 and $100 for a power of attorney. For couples wanting both powers of attorney and wills, it’s $700 for all six documents as a package deal.

When deciding who to name as an estate trustee, Fletcher suggests family is best.

“Friends come and go but family is forever. It’s a good idea to appoint a close family member who is good with administrative skills,” she said.

“It has to be someone who is at least 18, so adult children are typically named. If you are younger, it would usually be a sibling or a parent.”

If a person dies without a will, it is called intestate succession. In Ontario this is governed by the Succession Law Reform Act, which provides rules that set out who inherits the estate in specific situations.

“I think it’s extremely important to have both your will and powers of attorney in place,” Fletcher emphasized.

“It doesn’t have to be complicated. Something simple is better than nothing and is to the benefit of your family.

“It’s just very unfortunate, some of the circumstances we’ve encountered when people die without a will. Dealing with death is difficult at the best of times and without a will it becomes even more stressful for family and loved ones.”

Having a will in place can provide peace of mind, ensuring assets are distributed in a way that aligns with one’s wishes and values. It can prevent family conflicts, minimize estate taxes, and provide some comfort to those left behind.