GUELPH – Wellington County council has approved a 2024 budget with a 4.6 per cent increase to the local tax levy.

The increase, approved at the Jan. 25 meeting, brings the 2024 levy (the portion of the budget raised through local taxation, as opposed to grants, user fees, reserves or other sources) to $128,837,600.

In dollar terms, the increase means a hike of $30 per $100,000 of residential assessment.

“County Council passed the 2024 budget under challenging circumstances,” states Warden Andy Lennox in a press release issued after the meeting.

“This budget protects core services and makes significant investments in infrastructure, housing, ambulance, long term care, and the Ride Well Rural Transit Service,” the warden added.

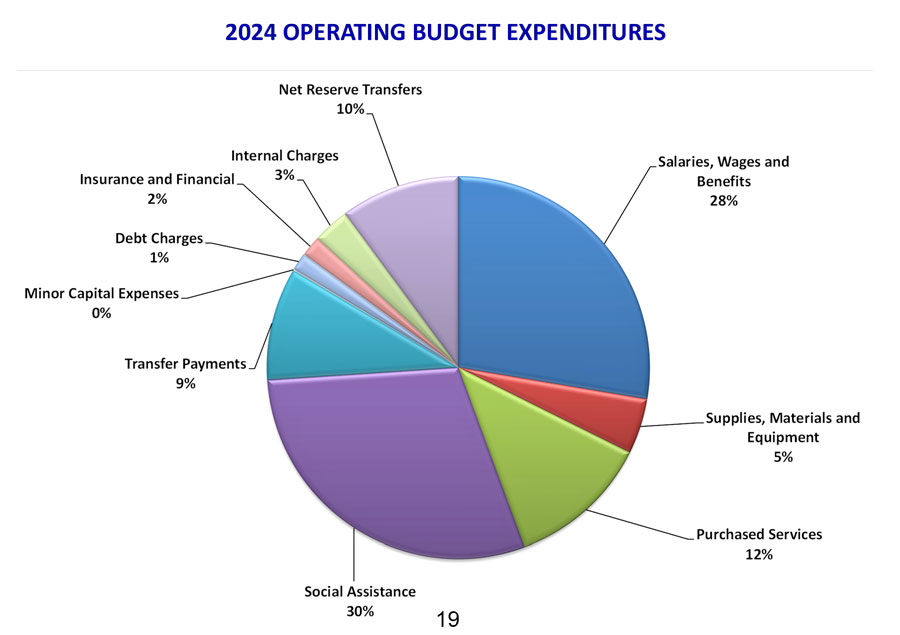

Budgeted expenditures for 2024 total $301,412,900 against projected revenue of $172,575,300.

A report from county treasurer Ken DeHart notes the 2024 budget is “fairly consistent” with a preliminary budget presented to county council in November.

“This is despite the fact that the county received notice of a significant drop ($488,000) in Ontario Community Infrastructure Funding (OCIF) in December,” the report points out.

The loss of provincial funding required an increase to the county’s capital reserves to maintain an adequate level of funding to provide for the same level of investment in the capital plan, the report states.

One of the key adjustments offsetting the OCIF shortfall is a 50 cent increase to the user pay garbage bag fee as of July 1, 2024.

This increase, from $1.50 to $2 per small bag and $2 to $2.50 for large bags, is expected to bring in additional revenues of $300,000 in 2024.

Other adjustments included additional Canada Wide Early Learning and Child Care (CWELCC) funding and resulting changes to the cost sharing formula, reducing county costs by $240,000.

The adjustments changed the tax impact to 4.6%, compared to 4.8% proposed in November, the report states.

Councillor Jeff Duncan presented an amendment to the budget motion calling for council to forgo the increase for user pay garbage bags.

“It is a little bit punitive for our residents,” said Duncan.

Duncan explained the fees were put in place “to be a carrot, incentive or a stick, whatever we want to call it, to make sure that people use the diversion programs (recycling, compost, yard waste pickup) that we have, and they’ve done that.”

Councillor Doug Breen suggested any fee increase should take into account the potential to discourage people from using the county’s waste disposal system.

When fees get too high, he suggested “It gets burned. It gets buried. We know that it has negative effects.”

Citing a recent staff report, councillor Dave Anderson pointed out the county’s fees are lower than some other municipalities.

“The current rates or fees we’re charging are at the lower end, compared to other areas with a user pay system. So even with this increase, we’re still at the lower end of that,” he noted.

“I think the way to handle those kinds of increases is exactly the way we are, taking a little bite at a time,” said councillor Campbell Cork.

Cork said an informal survey of his neighbourhood revealed most households are putting out one bag every two weeks.

“So we’re talking much less than the cost of a Tim Hortons coffee that we’re going up by each month,” said Cork.

The amendment to eliminate the fee increase from the budget was defeated, with only Duncan voting in favour.

Pavilion revisited

A proposal to build a $1.35-million pavilion at the county’s Aboyne campus, part of the county’s master plan for the property, was also questioned at the meeting.

Councillor Gregg Davidson presented a motion calling for the project to be sent back to information, heritage and seniors committee to be revised and built within the original $775,000 estimate and $600,000 to be removed from the tax levy.

While noting he feels the pavilion is a worthwhile project, Davidson stated, “the adding of $600,000 to the budget to on top of the $775,000 that’s already in place, well, that kind of bothers me and it’s unacceptable.

“We need to put the brakes on this runaway train that we are seeing with some of these developments,” said Davidson.

Councillor Shawn Watters said he liked the idea of revisiting the design and budget for the project, rather than simply scrapping it.

“I think, we need to have a bigger discussion on how we do procurement, on all our projects, especially in this time,” said Watters.

Councillor Doug Breen agreed with the need to look at the procurement process in relation to budget projections.

“However, it’s curious to me that we’ve chosen this (project) to be the scapegoat for what’s going on province-wide in the world of municipal politics,” Breen stated.

“This is a relatively small project. It will be very, very popular, will be very, very heavily used,” said Breen, noting the project has already been scaled back from the original concept, which included an amphitheatre and other features.

Breen said he was concerned a review would involve spending additional funds on design for a scaled back project that wouldn’t meet community needs.

“I think we all agree that it would be a lovely facility to have. But I think the only thing we’ve agreed on is what we can afford,” said councillor Campbell Cork.

“I don’t think this is a sacrificial lamb by any stretch of the imagination. I think this is a template for where we have to go in this new world. And if that is a change in policy, I think this is a good spot to make a statement and to start that ball rolling, because we’re in a new world post-COVID and we’ve got to do this more,” said Cork.

DeHart pointed out that removal of $600,000 from the 2024 levy as the motion called for could not be offset simply by a reduction of $600,000 from the project budget because “we’ve changed the way we fund our capital budget now. We don’t fund them project by project we take a long-term approach.”

DeHart explained the project was to be funded by withdrawing from reserves over a 10-year period, so cutting the levy by $600,000 lowers base capital funding for future years, leaving a $600,000 gap going forward.

DeHart’s interjection led to discussion on the workings of the 10-year budgeting process.

“I’m a little lost in that I agree with the treasurer’s comments if this was deferred and it’s going to come back in a year and get put back in that’s a fair comment. If the expense is eliminated. I don’t understand that comment,” said councillor Earl Campbell.

“If we pull $600,000 in levy pickup this year … if you kill it off, if you eliminate that $600,000, in revenue, that $600,000 is now gone. So you’re going to need to make it up whether this project moves ahead or not. It’s capacity. It’s tax capacity,” explained councillor Chris White.

“What I’m hearing is if we make this cut it’s going to come back to bite us and by that kind of logic, I take don’t ever make a cut because it’s going to come back and bite you,” said Cork.

“To me, the message is make the cut and if that’s going to hurt us next year, maybe we’re going to have to tighten the belt again next year. We’re talking about one project right now and we’re talking about one budget right now,” Cork added.

“Yes, this would be treated as a one-time $600,000 reduction to the 2024 budget, but the money is still required in 2025,” explained DeHart.

“Certainly you can make cuts, but we just have to tie the way we’re funding our capital plan to the cut itself. So if we’re taking $600,000 out of the 10-year plan and we’re funding our 10-year plan, essentially over a 10-year period, that means you’ve reduced the budget by $60,000, not $600,000,” the treasurer added.

“If you think of the base level of taxation as brick wall … If you don’t add a brick to the brick wall … It means you’ve lost that brick forever,” Breen pointed out.

“The problem is the plan, the 10-year plan, is built on the assumption that brick is there. So eventually, you either have to put on two bricks or you’re one brick behind, forever,” he added.

“If the goal when we came here today was to reduce the 2024 tax rate, we aren’t doing that …

If you were hoping for the headline of ‘Council reduces taxes by half a percent’ today, that’s not what you’re going to do,” Breen continued.

“I find councillor Breen’s remarks that anyone who doesn’t think the way he thinks are headline hunters, I find that offensive,” Cork replied.

In response to DeHart’s input, Davidson amended his motion to remove the reference to reducing the 2024 tax levy by $600,000.

The amended motion, calling for removal of the $600,000 proposed in the budget for the pavilion and directing staff to report to the information heritage and seniors committee with options that don’t exceed the $775,000 already set aside in the 2023 budget, was passed in a recorded vote.

Lennox, along with councillors Anderson, Cork, Davidson, Campbell, Michael Dehn, Steve O’Neill and Dave Turton, supported the motion. Councillors Breen, White, Duncan, Watters and Matthew Bulmer and James Seeley were opposed. Councillors Mary Lloyd and Diane Ballantyne were absent from the meeting.

County of Wellington image

10-year plan

The 10-year plan calls for a levy increase of 4.7% in 2025, followed by increases ranging from 3.8% to 3.3% for the next three years before dropping under 3% for the balance of the plan.

The 10-year capital plan projects $574.8 million of investment in infrastructure, facilities, and equipment between 2024‐2033, including:

- $37.4 million for roads, bridges, and culvert improvements – including construction of the new public works garage in Arthur and funding for the reconstruction of the first of four bridges on Wellington Road 109;

- facility upgrades at Elora and Rothsay Transfer Stations to provide similar infrastructure, working conditions and patron experience to the other four county waste facilities;

- 24 new emergency shelter beds and 12 transitional housing units at 23 Gordon Street in Guelph with support from the federal and provincial governments;

- ambulance service expansion, including the addition of nine new paramedics aimed at improving response times;

- enhanced direct care hours at Wellington Terrace Long Term Care Home – supported by the provincial government; and

- increased service levels for the Ride Well Rural Transit Service to provide additional availability for residents in need.

A $1-million provision was also included in the plan for the county to host the International Plowing Match (IPM) in 2032. Traditionally, the county has hosted the IPM every 16 years and last hosted the event in 2016.

Major capital projects for 2024 include:

- $37.3 million in spending on roads, bridges, culverts and related equipment and facilities;

- $5 million in capital repairs and enhancements for social and affordable housing units;

- and $7.3 million toward the construction of a new Erin Library Branch (total cost for the library is $12.9 million, with $5.6 million approved in previous budgets).

“The 2024 budget attempts to strike a careful balance between limiting the cost impact to county residents, while continuing to provide the necessary resources to deliver core services and maintain and improve the county’s critical infrastructure,” commented White, who chairs the county’s administration, finance and human resources committee.

Staffing

The budget provides for a 2024 staffing increase, including in-year changes from 2023, of 15.7 full-time equivalent (FTE) positions.

Among the changes are hiring an additional communications officer and a human resources recruitment specialist and conversion of 10 seasonal roads department equipment operator positions to full time. Combined with other changes, staffing measures in the 2024 budget bring the county’s staff level to 763.2 FTE from 747.4.

The net impact of all staffing changes is just under $900,000 in 2024.

The budget includes a 4% economic adjustment for non‐union members in 2024, as approved by County Council in November.