GUELPH – This year’s county budget is taking shape en route to its anticipated approval at the end of the month.

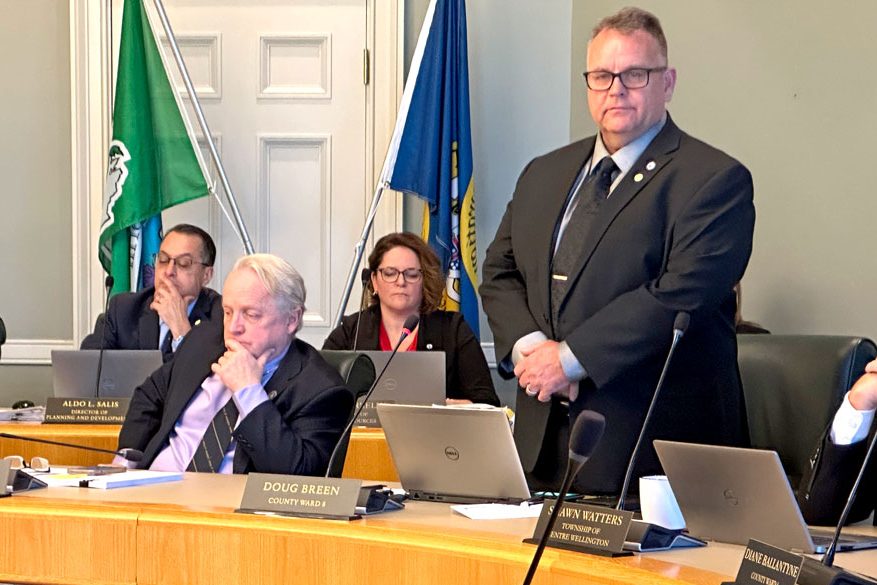

Treasurer Ken DeHart provided an updated overview of Wellington County’s proposed 2024 budget and a 10-year forecast of capital demands at a special meeting on Jan. 8.

Prior to a December break, staff presented council with a proposed 4.8 per cent tax levy increase for this year, following the removal of a $1.6-million broadband internet capital project.

But the county hadn’t yet been told of a $500,000 reduction in infrastructure funding from provincial tax dollars.

That meant county finance staff had to reassess what they were working with.

Changes to the budget, reducing the tax levy by $195,000, have since brought the proposed levy increase down to 4.6% from 4.8%.

The overall operating budget this year is estimated to ring in at around $301 million; and the capital budget around $75 million.

The proposed total to be raised from taxes is $128.8 million, including an increase this year of $8.4 million.

Key to getting the slight reduction in the levy increase is a staff proposal to raise the fee for the county’s yellow garbage bags by 50 cents per bag as of July 1.

There’s more discussion about that to come at the committee level, but if the recommendation is supported by council, it would generate $300,000 this year, according to DeHart.

If the solid waste committee and council don’t move forward with the increase, the levy will sit between 4.8% and 4.9%.

Costs for roads and bridges are the heaviest demand on the tax levy (29%), followed by the county’s contract with the OPP for policing (14%) and the cost of administration (12%).

Operating increases

A sample of operating budget increases across departments include:

- converting 10 seasonal snowplow operator positions into full-time equipment operators;

- a $600,000 increase to the curb-side garbage collection contract;

- new civilian media relations coordinator for the OPP, pushing an increase to the policing contract cost just over 2% in 2024;

- $5.2-million increase to social and affordable housing budgets for more shelter spaces, rent supplements, housing maintenance and several staff;

- new staff positions at Wellington Terrace Long-Term Care Home;

- nine more paramedic positions at a cost to the county of $719,000;

- improved Ride Well service levels and driver hourly rates at a cost of $240,000;

- continuation of the Smart Cities program and two staff positions with a budget increase of $170,000;

- increase to the Source Water Protection Program budget of $80,000; and

- a number of new staff, including human resources positions, a new communications staffer, maintenance worker, and admin assistant.

New county staff positions account for an additional $789,100 in operations spending this year. The number of “full-time equivalent” positions could increase from 752 to 763 in 2024.

Easing inflationary pressure over time

The county is expected to draw on its reserve accounts more than usual in the coming years to absorb significant capital expenses.

At the end of 2023, there was an unaudited total of around $110 million held in reserves.

Projections suggest $3.6 million could be withdrawn from those reserves by the end of 2024, predominantly for capital.

Over the pandemic years, project spending fell, so reserve accounts were bolstered, DeHart explained.

Now, with inflation, he said there will be “significant pressure” within the first three years of the county’s 10-year forecast.

“Our strategy has been to phase in some of the inflationary cost increases … over a two- to three-year period, so that’s why we’re seeing a draw on our capital reserves the first few years of the forecast,” DeHart said.

“Over time, as long as we stick with our long-term plan, we should be able to improve those when times get a little bit better,” he added.

Through to 2033, the county is looking at spending around $575 million on capital work.

Most of that spending is proposed for roads and bridges, followed by social and affordable housing, and new ambulance stations.

A decade of debt

The county anticipates relying on $81.8 million of new debt in the next decade – $20.5 million covered by taxpayers and $61.3 million covered by fees paid by developers – to pay for new roads garages, ambulance stations, road construction, a new Erin library, and an upgrade to the Elora waste facility, among others.

“The province’s decision to limit our ability to collect development charges, and all of the legislative deferrals that they’ve made, as well as the increasing cost of capital … all three of those things are factoring together to increase out reliance on growth-related debt,” DeHart said.

Tax-supported debt and the cost of interest remains “relatively stable” however, DeHart told council.

“We’ve got a couple of challenging years ahead,” DeHart remarked.

There’s a tax levy increase of 4.7% forecasted in 2025, but DeHart cautioned that’s largely based on projections, and federal and provincial infrastructure funding is trending down.

If councillors are looking to reduce levy demand this year, DeHart suggested not deferring projects to future years.

“Otherwise, we might find ourselves in a difficult position,” he said, suggesting council instead look to “concrete cuts or other adjustments.”

The budget is being discussed in the coming weeks at the committee level and the Police Services Board before it’s expected to come to council for final consideration on Jan. 25.