WELLINGTON COUNTY – The county recently passed a new bylaw that increases development charge rates paid by developers between 20 and 45.6 per cent per unit, depending on the type of development.

The change comes following the largest collection of fees in the county in nearly a decade.

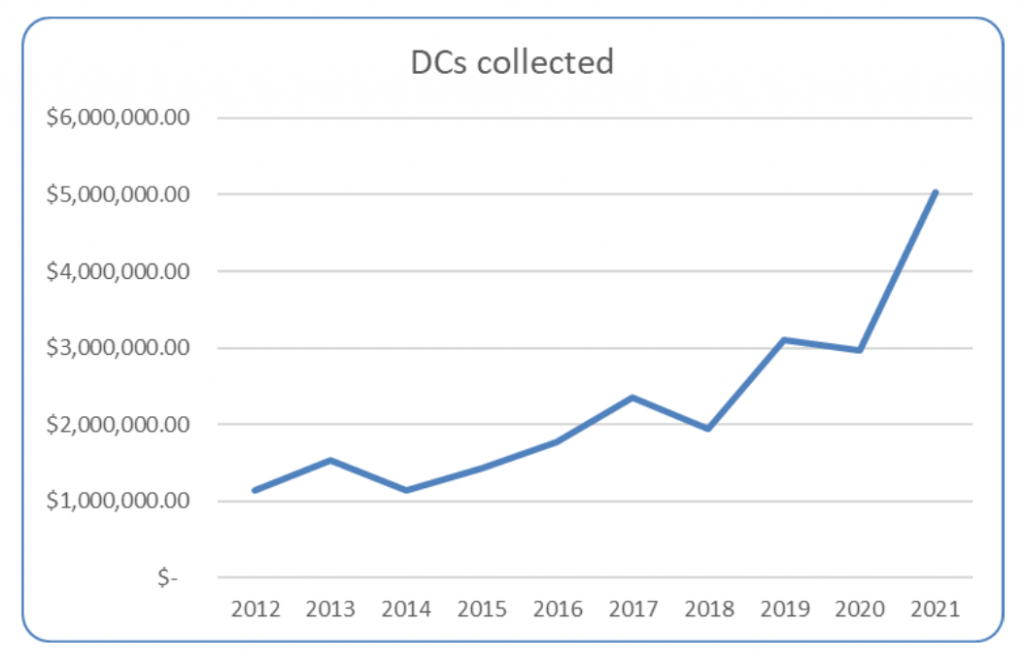

Last year, the county collected $5.03 million in development charges — a 69% increase over the $2.96 million collected in 2020.

Between 2020 and 2021, there were significant increases in the charges collected for single dwellings, apartments, multiple dwellings, and non-residential categories.

The vast majority of growth was in Centre Wellington, accounting for 60% of residential and 76% of non-residential collections, according to a 2022 county report about last year’s charges.

A graph shows eventual growth in the dollar amount of development charges collected between 2012 and 2021. (Wellington County graph)

Increased development means increased demand on needed services, such as road work and ambulances. The money to pay for those services must come from somewhere, and development charges help growth pay for growth.

The county hired Watson and Associates Economists Ltd. to complete a background study looking toward future development and demand on services, as well as looking back across the previous decade of historical demand on services.

That study, completed in March, provided the basis for rate changes approved by county council in May and taking effect on June 1. The bylaw remains in effect until 2027.

For single- and semi-detached homes, the rate per unit now is $8,988 — an increase of 45.6% over the annually indexed rate, most recently adjusted in January.

(The rate here increases each year on Jan. 1, based on Statistics Canada’s Building Construction Price Index.)

For multiple dwellings, such as townhouses or the residential portions of live/work units, the rate has increased 39% to $6,783.

For bachelor apartments and those with two or more bedrooms, the rate has increased between 20 and 34%, depending on the size of the apartment, with a range of $3,908 to $4,793.

Non-residential development charges have increased 40% to $2.50 per square foot.

So far this year, $1.22 million has been collected in development charges, with portions going toward reserves for roads, policing, libraries, growth studies, long-term care, child and early years services, public health, administrating provincial offences, ambulance service, and waste diversion.

Each year, county treasurer Ken DeHart produces an annual statement detailing collected development charges and where the money has gone for the most recent year.

Last year, the county transferred $1.31 million in collected development charges out of reserves to pay for new library materials, the recent development charge study, an official plan update, a transportation master plan, and various roads and building work.

Loans can be taken to “remove” development charges from reserves before the charges are collected — the idea being the debt will eventually be paid down by future collections.

At the end of 2021, the county had $10.2 million in development charge debt. Just shy of $1 million in such debt was paid down last year.

A $365,079 internal loan, taken from the county’s property reserve fund in advance of collecting development charges for the social service category, will likely have to be written off, however.

Historically, the county would collect development charges for social services and pay back such a loan, used in advance of the actual collections, DeHart explained.

But with the passing of the More Homes, More Choice Act and the COVID-19 Economic Recovery Act, social services are no longer eligible to benefit from development charges, meaning the debt in that category can no longer be recovered.

“We essentially will have to write that amount off, or not pay it back to the property reserve,” DeHart stated in an email.

Charges were able to be collected until May 31, so the amount will likely be closer to $325,000, according to DeHart, but the true amount won’t be realized until the year’s end.

The county closed out 2021 with a balance of $6.94 million in development charge reserves.