WELLINGTON COUNTY – In the current economic landscape, paying down debt can seem like an insurmountable task, especially with the ever-rising cost of living.

However, amidst the challenges, there are avenues to explore and strategic plans to implement that can pave the way to a debt-free future.

Sheldon Morris, a certified financial planner with Vision Financial Services since 2006, brings a wealth of experience in income tax preparation, investments, and financial planning.

While Vision Financial Services primarily focuses on wealth management and tax planning preparation, Morris shared insights and tips on managing high-interest debt.

It’s important to examine loan statements and bills thoroughly, ensuring a comprehensive understanding of monthly debt obligations and the associated interest rates on various debts.

“People don’t realize where they’re spending their money. It feels like a little bit here, a little bit there, but when you tally it up, it can be very expensive, and in my experience it’s very surprising to people,” Morris emphasized.

Keeping monthly debt obligations and essential expenses below your income is key.

If it’s challenging to cover crucial bills, explore options such as negotiating with lenders or seeking additional income.

“I know people want a magic bullet, but it doesn’t exist,” Morris said.

“Start by knowing what you’ve got coming in, knowing where you spend money, and then come up with a plan to reduce spending in order to tackle the debt.”

Examining debts and focusing on settling those with higher interest rates, such as credit cards or personal loans is a good first step.

Neglecting high-interest debt can result in a substantial portion of your money being squandered on accrued interest.

Consider a $5,000 credit card debt with a 20 per cent interest rate and a $5,000 personal loan with a 5% interest rate.

If you focus on paying off the credit card first, over a five-year period, you could save around $2,500 in interest compared to prioritizing the personal loan due to the higher rate.

“Getting the lowest interest rates, obviously, is very helpful, and that’s where you can try and talk to a lending institution like a bank or credit union who can take multiple sources and consolidate them into a better rate overall. But you still have to pay it off, and the only way to do that is to divert other spending,” Morris said.

“If you’re trying to pay down debt, getting a lower interest rate is great, but you still have to be paying it down plus the interest.”

Another thing to consider is doubling the number of payments made whenever possible, especially for high-interest debt.

Paying more than the minimum can accelerate the time it takes to get out of debt.

By increasing the payment amount, the rate at which the debt declines is increased and the total interest is reduced.

“At the core of it, if spending habits don’t change, you’re just going to build up the high interest again. [It’s important to] know where you’re spending your money.”

When it comes to prioritizing debt, Morris suggests, “if you are self-employed, and work from home, you definitely want to take care of the debt that’s not related to the business – personal debt, as opposed to business debt.

“From a tax perspective, there’s good debt and bad debt. Good debt is debt that you can write off the interest.

“You have debt because of your business – that interest is a business expense. You don’t have to pay tax on that money, so it’s tax deductible.”

Morris underscores the importance of budgeting as the foundational step in the journey toward financial freedom.

“Step one is budgeting. Know your current financial situation and timeframes, because without that, you don’t know what your options are.”

But knowledge alone is not enough.

Morris adds, “Knowing is one thing, but then you need to have the discipline to do what you’re supposed to do.”

Cutting back on unnecessary expenses is a fundamental part of getting out of debt. Review regular expenses and identify which are necessary, such as food, housing and utilities, and which are not, such as entertainment or clothing.

To encourage financial discipline, Morris recommends practical methods.

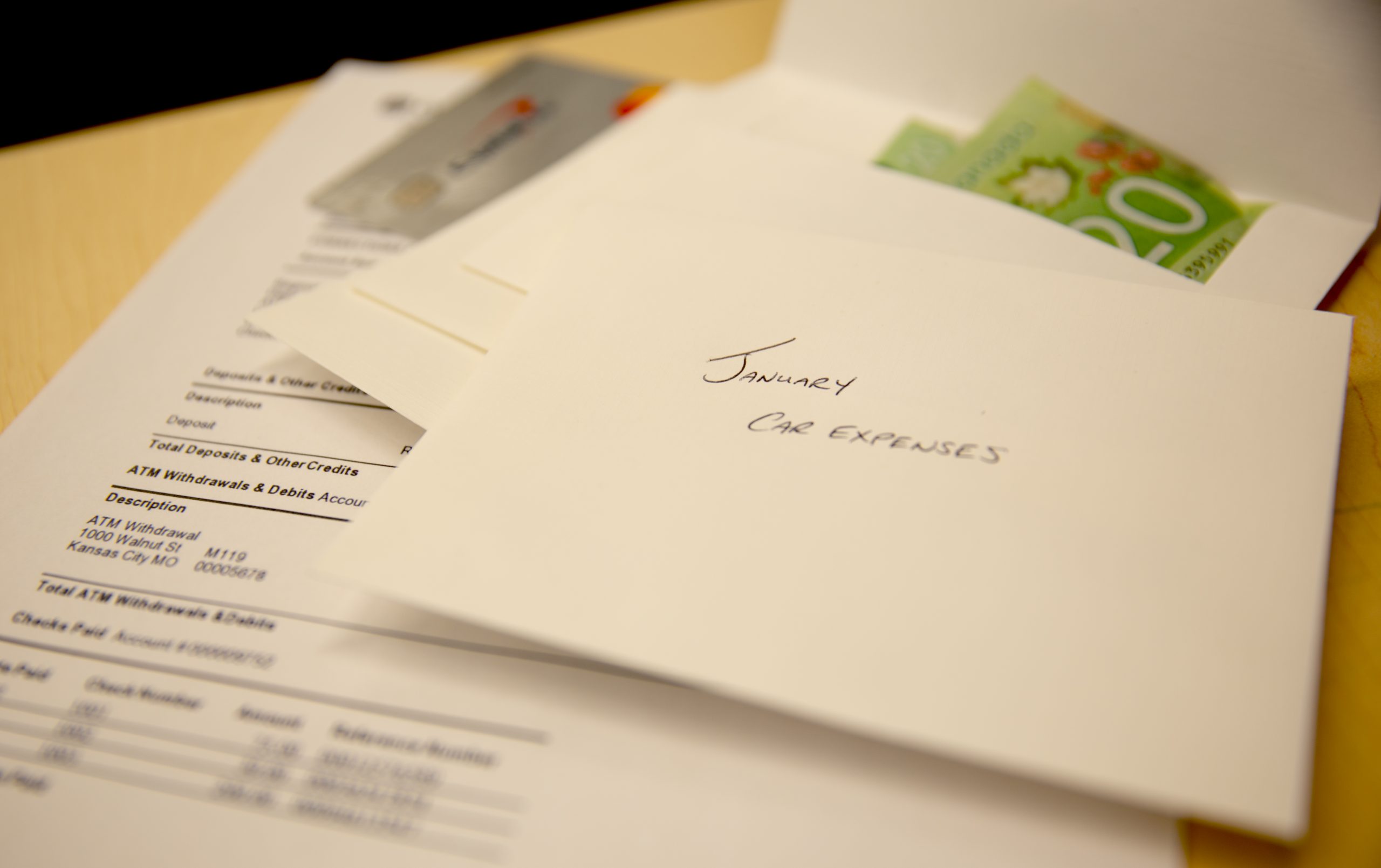

“I’ve known people who will literally use cash envelopes. It’s a way of disciplining themselves with their budget, especially when it comes to discretionary spending.

“They’ll budget a certain amount in cash and put it in an envelope labeled for whatever that category is. When the envelope is empty for the month, that’s it.”

“There are a few tricks, but it really comes down to the knowledge of where money is being spent, and having the discipline to do what you need to,” he added.

Moreover, Morris highlights the importance of maintaining an emergency fund.

“You want to have an emergency fund, just in case, and you don’t want to completely deplete that just to pay off debt.

“The emergency fund is set up to avoid getting further into debt – it’s there for a rainy day, and if you’re getting hurt by high-interest payments, it’s a rainy day.”

As individuals grapple with high-interest debt, the path to financial liberation involves a combination of strategic planning, disciplined budgeting, and a comprehensive understanding of one’s financial landscape.

Morris’s insights provide a roadmap for those looking to navigate the complexities of debt and emerge on the other side debt-free.

For more information on wealth management or to schedule a consultation, Vision Financial Services offers valuable resources at visionfinancialservices.ca or through email at office@visionfs.ca.