MINTO – Town council has been presented with a proposed 2024 budget projecting a 4.39 per cent increase in the local levy and a tax rate increase of 1.74%.

That translates into an additional $9.33 in taxes per $100,000 of assessment or $23 for the average residential property owner.

The average residential property in Minto is valued at only $250,000 due to a province-wide lag in current value assessment generated by the Municipal Property Assessment Corporation.

The corporation’s scheduled reassessment program was paused during the COVID-19 pandemic and has not yet resumed.

The draft operating budget, presented at a special council meeting on Nov. 7, estimates a levy (spending supported by local tax dollars, as opposed to grants, user fees or other income sources) of $6,304,700 in 2024, up $264,900 from the $6,114,900 budgeted for 2023.

Treasurer Gordon Duff said the 2023 budget figures represented something “closer to normal” after several years of budgets impacted by the pandemic.

“And in ’24 … it’s more keeping doing what we have been doing. There aren’t any new initiatives or anything,” he stated.

“Bottom line, we’re looking at a 4.39% levy increase, which is close to inflation.”

Duff noted inflation hits municipalities harder than some other sectors.

“When we talk … about inflation in the municipal context, our raise is far above the CPI (Consumer Price Index), I’m afraid. We’re into a lot of things where, in the market, there’s a limited number of suppliers,” he explained.

“And we’ve often said we’re kind of in the property management business too, so you’ve got a lot of double digit increases and we keep trying to find efficiencies and try and keep the overall increase as something that’s a little more manageable.”

Among the projected costs driving the budget increase for 2024 are:

- a $17,500 increase in insurance premiums;

- $35,000 bump in group benefit costs;

- additional $50,000 for IT support;

- $18,000 in part-time labour costs for the fire department;

- $21,900 for utilities; and

- $34,000 in additional spending on vehicle fuel and maintenance.

A cost of living (COLA) increase of 4% for municipal staff will add about $178,200 to payroll costs in 2024.

Duff reminded council the CPI increase includes a portion of the 2023 COLA increase that was deferred to avoid a much larger increase.

The town’s human resources policy calls for a staff COLA increase based on the September CPI, which would have resulted in a 6.9% increase in the last budget.

Instead, council agreed to a staff proposal to cap the 2023 increase at 4% with the option to carry forward the remaining 2.9% to a future year.

“This is based on policy, which is the September CPI of 3.8,” Duff noted.

“And you will remember a year ago we had to do the carry forward, so it’s 3.8 from the September CPI plus point two, using up some of that carry forward.”

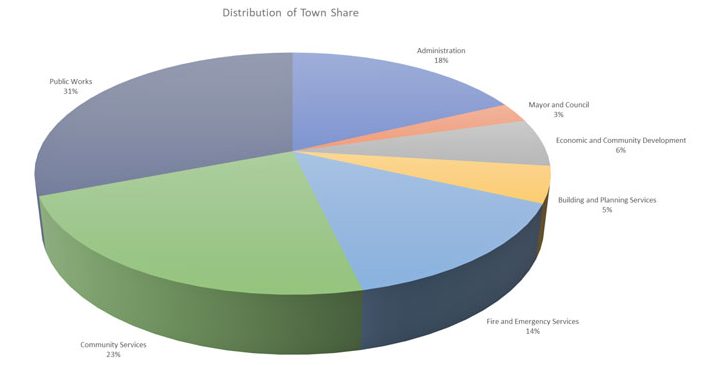

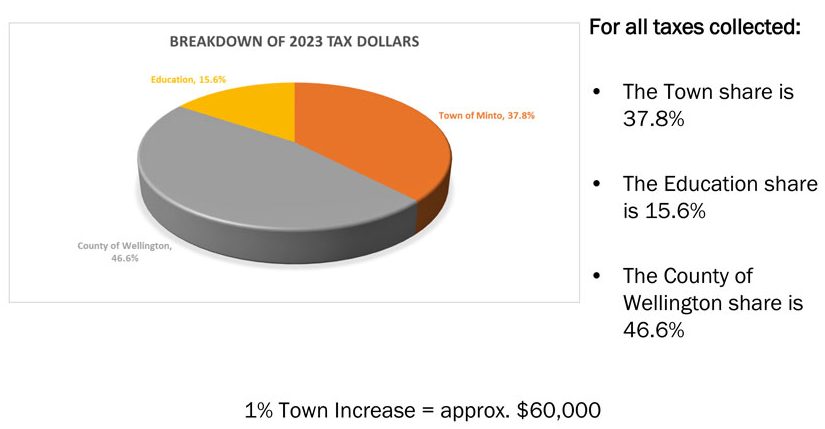

Chart showing how property tax dollars are allocated between provincial (education), county and local levels of government. Minto council agenda image

Staffing wise, the budget is based on maintaining the same compliment of employees, a total of 51.5 full-time equivalent workers, not including volunteer firefighters, seasonal workers or casual employees.

Community services and public works departments include the largest share of workers, with 12 and 10 employees respectively.

Deputy mayor Jean Anderson asked for information on total employee numbers including non-full-time workers.

“They’re not on this chart, but they are included in labour costs in each department … I think if you look at T-4 slips it’s over 200, but that could include a person that worked five hours at a bar at the community centre, but it’s also all our seasonal (workers),” explained Duff, who said he would attempt to compile the information for the next budget session on Nov. 28.

Also impacting the budget is a decrease of $18,700 in the Ontario Municipal Partnership Fund (OMPF) grant from the province.

Minto will receive $1,473,600 from OMPF for 2024, compared to $1,492,300 in 2023.

“Minto, of course, is very dependent on this grant and it’s down a bit – not so much this year, but if you look at even two years ago, it’s down about $60,000,” Duff pointed out.

“I think we peaked in 2017, so we’re down well over $300,000 since then and you can see prices certainly haven’t stayed the same.”

On the positive side of the ledger, assessment growth will add about $10,000 in tax revenue and adjustments in various other areas reduce the overall spending total by about $98,000.

Mayor Dave Turton asked Duff if the additional IT spending would bolster the towns’ defences against cyberattacks.

“Some of the municipalities that have been breached, obviously you don’t know what they’ve done, but they likely have not put in the firewalls that Minto has,” said Turton.

“We’re trying. It’s tough. You’re not competing, but you’re defending against people that are also investing in their hardware and their time and you’re trying to stay a step ahead,” replied Duff.

“But larger institutions are often breached. I think they’re more of a target and we try and do our best and at least control what we can.”

Minto’s mayor and council members will receive the same 4% COLA increase as staff.

The administration budget projects total spending on council compensation will rise from $190,000 in 2023 to $206,700 next year.

“For the mayor and council we are looking at change of 8.8%. A lot of that is changes that are being driven by cost of living, as well as some adjustments to fringe benefits provisions such as OMERS and health care accounts,” explained clerk Annilene McRobb.

Minto staff traditionally chooses a theme when preparing the annual budget presentation. Interim CAO Mark Potter told council the 2024 budget theme is “moving forward.”

“Work is well underway on updates to the town’s strategic plan, and various master plans,” said Potter.

“It is anticipated that this work will be completed in the first part of 2024, providing the town roadmaps that will focus our efforts in the delivery of services.”

The budget process continues on Nov. 28 with a review of changes and updates from the Nov. 7 meeting and presentation of the proposed 2024 capital budget.

A public budget open house will be held on Dec. 5 from 5 to 6pm in the council chamber.