WELLINGTON COUNTY – The Bank of Canada’s campaign against high inflation appears to have at least decelerated the rising cost of living, but it remains to be seen if the Canadian economy will escape this inflationary period with a soft landing or a hard one – i.e. with or without a recession and significant job losses.

In the interim, new data from the non-profit Angus Reid Institute finds half of Canadians under 55 years old worry they will be affected by job loss in the event the economy turns.

Further, a majority of the cohort most worried about job loss are more likely to have a smaller financial cushion underneath them to soften a potential blow.

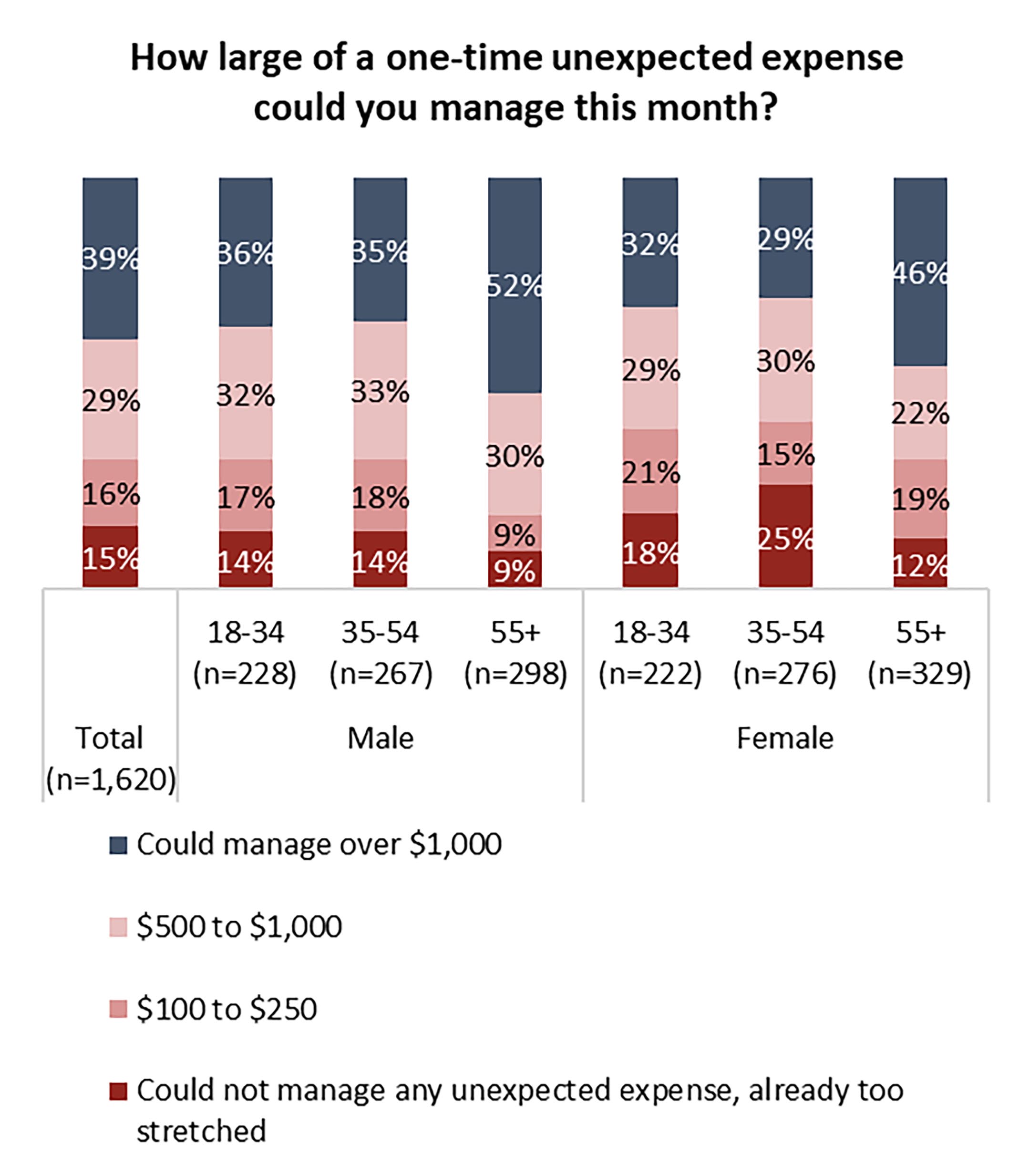

A majority of those under 55 say they could not handle a sudden expense of more than $1,000 in the coming month, including one-quarter of women aged 35- to 54-years-old who say they can’t manage any unplanned bills because they are “already too stretched.”

This lack of wiggle room also affects many Canadians’ retirement savings planning.

Two-in-five say they don’t contribute to a TFSA or an RRSP because they don’t have anything left to save.

As housing costs continue rise from this period of high interest rates, renters and mortgage holders feel squeezed.

Majorities in those groups say they don’t have the capacity to accommodate a sudden expense of anything more than $1,000. Meanwhile, that would not be an issue for a majority of homeowners who have paid off their mortgage.

Link to the poll can be found at angusreid.org.