Out with the old, who knows about the new

As the year ends, the best of hopes is wished for 2026.

It was a year of tumult as global issues, prompted in great part by U.S. President Donald Trump, shook markets, friendships and attitudes.

Big business does, pretty much, as big business has always done. It looks after its own interests and without sound regulation does so in a cavalier fashion. Smaller businesses are absorbed or rubbed out due to scale, leaving the marketplace less competitive.

The working poor, the committed souls who show up to work and get the job done for these behemoths continue to fall behind. For the most part they still smile, happy with friendships, family and the simpler things in life. No pension, apart from Old Age and Canada Pension Plan await them. They will work to the end.

Young people struggle too. Those fortunate to have scholarships or parents that saved have a leg up, but the reality is their struggle is significant. The price of homes and cars has made it such that inter-generational wealth needs to be shared.

To varying degrees this has always been the case, but the road to success has more obstacles than a decade ago.

Chatting with an old friend this past week we got talking about the old days. It’s hard to believe 40 years has passed, but we talked about credit and how significant it was when a neighbour got a new car.

Now, most driveways sport two or three relatively new vehicles and credit cards come in the mail. Saving for a rainy day or saving up for a big purchase seems so passe. A zip of a card, a transfer of funds on the phone seems so easy, but it all adds up to feeding impatient appetites that have become gluttonous in some cases.

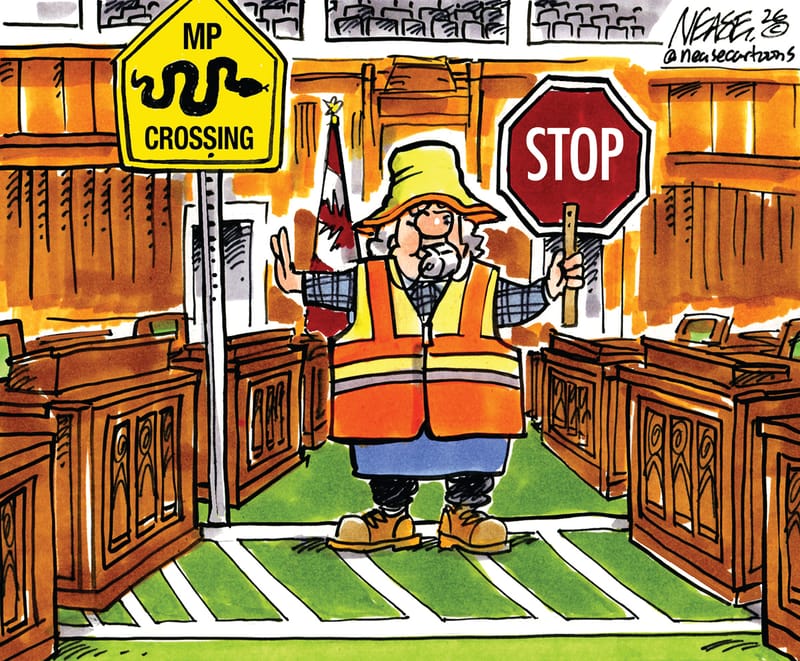

Governments are now no better. The shocking days of the 90s when the International Monetary Fund strongly warned the federal government to get its debt in order is long forgotten.

The cascading effect of that time spilled from federal cutbacks to provincial shake-ups that included downloading costs onto municipalities. Years of little or no assistance factored in some grim property tax increases at the time.

Here we are 30-plus years later and a full generation and a half of the working population has no idea of financial consequences associated with burdensome debt.

Cracks are beginning to show and it will be interesting to see how the economy performs. For over a decade, monied friends with experience in banking and investment have been quite sympathetic to our notion that something must give.

We haven’t really seen hardship since those days when PM Jean Chretien and Finance Minister Paul Martin took the bull by the horns. Markets and economies propped up artificially ultimately burst. We like to think of it like an old farm tractor chugging along. Opening up the governor and driving full throttle only lasts so long before the engine blows.

As we say goodbye to 2025, let’s be thankful for friends, family, our workplaces and one of the best spots on earth to call home.

Happy New Year, Wellington.