Minto proposes 4.1% tax increase in draft budget

MINTO – The town’s 2026 draft operating budget totals just under $7.3 million and will require a 5.6 percent tax levy increase.

Factoring in assessment growth, the net levy increase is about 4.1%.

The budget was presented to council on Nov. 4 by town chief administrative officer Gregg Furtney.

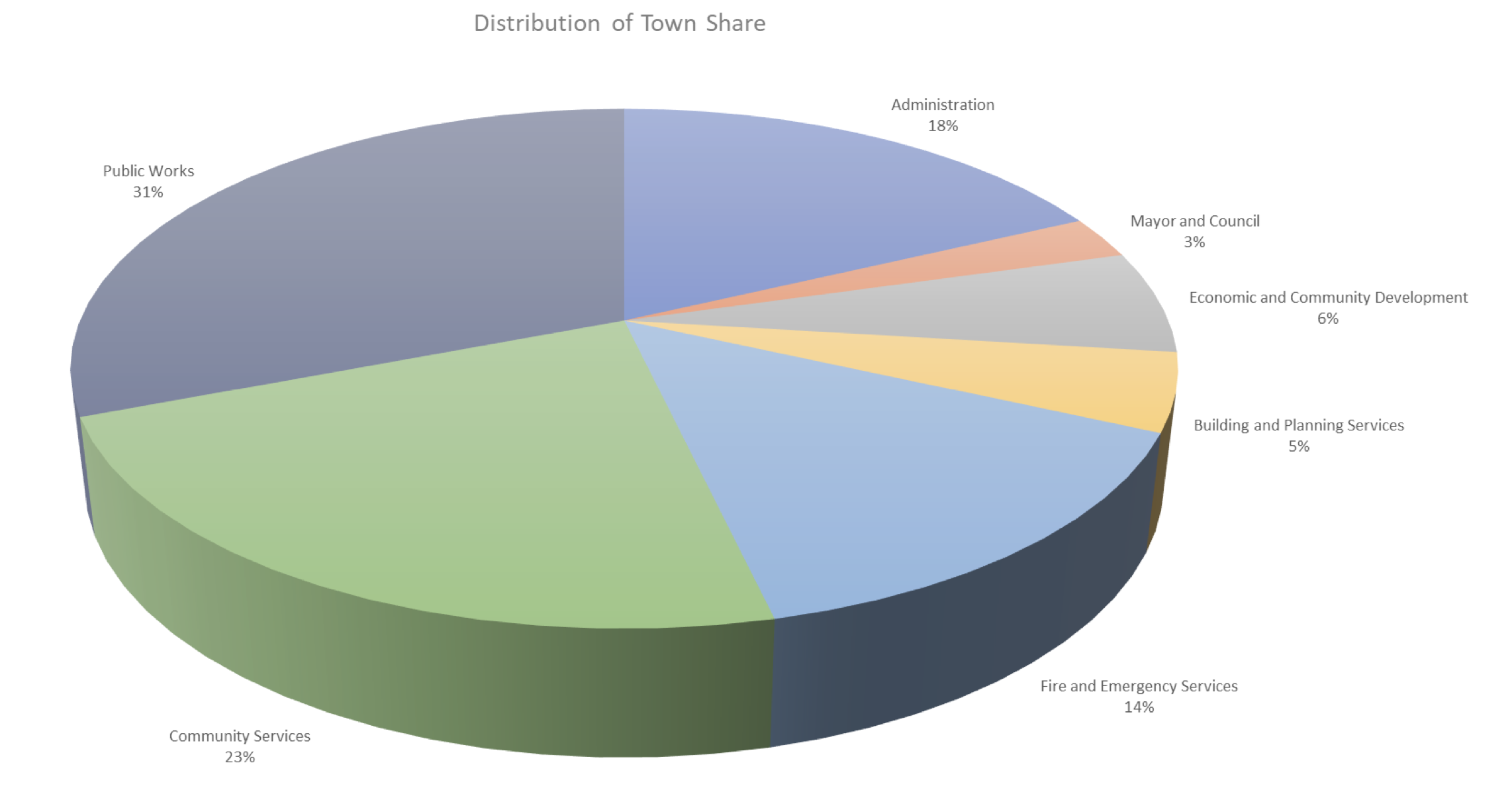

“The distribution of tax dollars is the same as it always has been,” Furtney said.

Of the total tax bill collected by the town, 37.3% goes to Minto, 47.3% to the county and 15.4% to the province for education purposes.

Of Minto’s share, 31% or $3.08 million will go to the public works department, while 23% ($1.97 million) will go to community services and 18% ($1.61 million) to administration.

The most expensive items in the budget are included in the public works department, including:

- roads administration, $1.39 million;

- roads and sidewalk maintenance, $1.01 million; and

- winter control, $735,000.

Last year council approved a 6.5% tax levy increase which resulted in a tax increase of 4.5% on an average house assessed at $250,000.

“We’re hoping to provide you folks with updated financial plans prepared by Watson and Associates,” Furtney told council regarding the budget’s water and wastewater services.

“So the amounts will increase and decrease once we have received those reports."

After presenting department summaries, Furtney introduced a proposed total of $627,000 in tax-supported reserve contributions.

“Contributions are down from last year, but we’re hoping this will help us balance the budget even a little bit better going forward,” he said.

Department amounts include:

- fire and emergency services, $200,000;

- public works, $191,000;

- community services, $171,000;

- administration, $50,000; and

- building and planning services, $14,000.

Policing, reserves

“Where does policing come in on the budget?” councillor Ed Podniewicz asked.

“That one is buried in our county levy so Minto pays nothing directly for police, but that is a significant part of the county levy,” town treasurer Gordon Duff replied.

Deputy Mayor Jean Anderson inquired about the decrease in contributions to the town’s reserves.

Duff noted staff have drawn more from reserves to get out of the eight or nine per cent tax-increase area.

“I think our reserves are still at an acceptable level, but times are tough ... so we’ve had to tap into our rainy day funds a bit to get it down to something manageable,” he said.

“Did we use reserves at all in 2025?” Mayor Dave Turton asked.

“Yes we did, roughly $250,000 ... [but] it’s probably a smaller figure because as we’ve all noticed we contributed more last year,” Duff replied.

Turton also asked if Duff had calculated an assessed rate for the average house.

“I have not yet because I don’t know what the assessment role will be, although indications [show] it won’t be that different from our previous assessment role," said Duff.

“It’s going to be very comparable to the previous years."

Council received the draft operating budget proposal for information.

Budget process, schedule

The next council budget meeting is slated for Nov. 25 at 3pm, at which staff will present the draft capital budget for information.

On Dec. 2, the town will host a budget open house in the council chamber from 5 to 6pm.

The final budget is to be presented to council on Dec. 16, which is also when the strong mayor budget process clock starts.

"There's certain powers the strong mayor can delegate," Duff told the Advertiser. "The preparation of the budget is not one of them.

"In the strong mayor legislation, it's the mayor's budget."

After the mayor's budget has been presented, under provincial rules council has a maximum of 30 days to propose formal amendments.

However, Minto has approved reducing that period to 15 days, so council will have until Dec. 31 to propose amendments.

If the mayor agrees to the amendments, "nothing else will change, but if the mayor disagrees he may issue a veto and that period is ... 10 days," Duff said.

If council wishes to overturn the veto it requires two-thirds of council to vote in favour.

"We're used to passing a budget bylaw, but we don't do that under this system," Duff said.

"Once the appeal periods [are over] the budget is deemed adopted."

Duff added council "didn't seek this power ... and they want to keep this as close to normal as they can."

According to the province, the head of council is required to propose the municipality's budget each year by Feb. 1.