Draft 2016 county budget contains 2.8% increase

Wellington County’s total tax levy will rise by 2.8 per cent if the draft 2016 budget is passed as currently configured.

However, it is larger increases projected in the county’s five-year forecast, beginning in 2017, that have some councillors concerned.

The projected 2016 levy increase is down from the 3.3% increase proposed in a draft budget presented to county council in November. The county’s treasury department presented the latest draft of the 2016 budget and five-year plan at a special council meeting on Jan. 11 at the Wellington County Museum and Archives in Aboyne.

The operating budget calls for expenditures of $191 million in 2016 and requires a tax levy of $88.1 million, a 2.8% increase over the 2015 levy.

Of the proposed $88.1 million 2016 levy, the county will spend $22.5 million, or 25% of the levy, on roads, $16.3 million on police, $7.8 on the Wellington Terrace Long-Term Care facility, $7.6 million on social services and $54.2 million on other services including libraries, health/ambulance, solid waste and administration.

The $191 million in total expenditures includes $77.5 million on social services, $25.6 million on roads, $20.6 million on Wellington Terrace, $16.7 million on police and $50.6 million on other services.

Changes to the budget from the draft presented in November include:

- an update on the Ontario Municipal Partnership Fund from the province resulted in additional 2016 funding reduction ($155,000);

- moving an economic development position to full time ($20,000

increase) and adding a CIP Consultant (50,000 increase) and the removal of a proposed new human resources position ($36,000 decrease);

- capital changes include adding accessible washrooms at the museum and removal of the main gate project ($75,000 total increase), as well as an increase of $30,000 for the Wellington signage strategy;

- an increased transfer from reserves of $140,000 to fund the Southwestern Integrated Fibre Technology (SWIFT) initiative;

- an additional $200,000 reserve transfer for roads; and

- updated land ambulance figures from the City of Guelph resulting in savings $113,000.

Major factors affecting the 2016 budget include:

- $769,000 in savings compared to the 2015 contract as the county moves into the second year of a new police billing model;

- reserve funding set aside for hospital grants ($1.5 million in 2016 – total $9.4 million by 2019), SWIFT rural broadband ($340,000 in 2016 – total $1.14 million by 2019);

- major investment in asset management with transfers beginning in 2016 ($200,000) and totaling $7 million over the five-year forecast.;

- OMPF funding reductions ($448,000 and 0.5% impact on tax levy);

- reduction in provincial offences act revenue ($280,000) offset by reduced transfer to capital - net negative impact $160,000;

- staffing additions include the addition of an asset management coordinator to the treasury department ($81,000 in salary and benefits) and a graphic designer in the administration department ($55,600); and

- reduction in solid waste services recyclable revenue ($200,000 and 0.2% impact on tax levy).

Treasurer Sue Aram presented a five-year forecast on asset management planning that showed the county with a deficit of $35.5 million at the end of the term if capital funding continues at current levels.

“This gives you an idea of the magnitude of the infrastructure deficit,” said Aram, who presented several options for reserve contributions to reduce or eliminate the deficit.

The latest forecast calls for levy increases between 2017 and 2020 of: 6.2% ($94 million), 4.9% ($100.1 million), 3.3% ($104.5 million) and 3.8% ($109 million). That contrasts with levy increases ranging from 1.9 to 2.8% between 2012 and 2015.

Councillor Alan Alls said the 6.2% increase in 2017 is the figure that most concerns him.

“Are we going to accept that?” he asked.

“I think the challenge to this council is how do we make the next four years the same as the last five?” said councillor Pierre Brianceau.

“That is going to be a big challenge,” said Warden George Bridge, who reminded councillors they would have a chance to “drill down deeper” in the budget figures at committee sessions this month.

Despite extensive planning, Bridge pointed out unexpected expenses can quickly change budget forecasts.

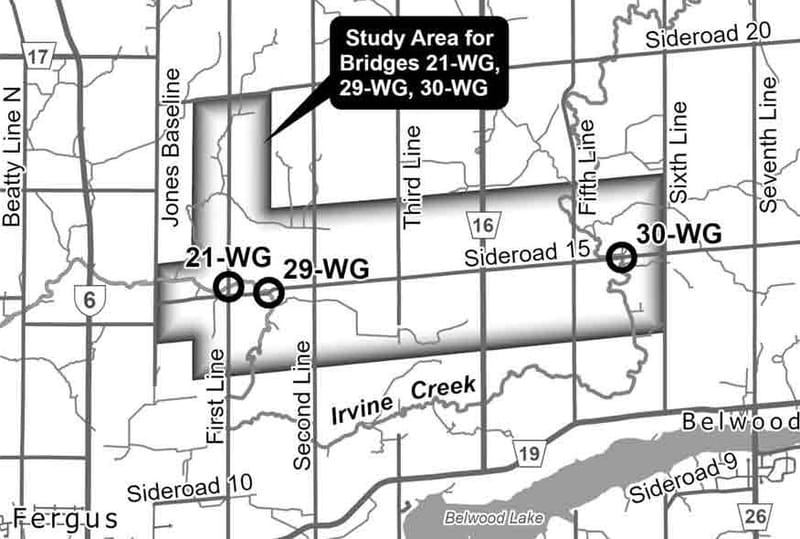

“A good example is the Badley Bridge. That came out of nowhere. We though we had a small fix on a sidewalk and we end up replacing the whole bridge,” the warden said of the $4-million project.

Aram pointed out, “Sadly the county was not selected to move forward to second intake for the Small Communities Fund (SCF) funding for the Badley Bridge project.”

Councillor Kelly Linton suggested that before the budget went back to committee council as a whole should make decisions on issues such as what level of debt the county is prepared to carry and how much should be held in reserves.

“How much is enough? That’s a council discussion,” said Linton, the mayor of Centre Wellington.

He also expressed concern about proposed increases in staff numbers, noting that since 2009 the county has added 78 positions, “while at the township we’re at one.”

Councillor Chris White pointed out the county figures include many provincially-mandated social services positions which are not funded through the county tax levy.

CAO Scott Wilson said other than the 2017 increase of 6.2%, the projected figures all represent “inflationary budgets.” He warned the county will eventually be forced to catch up on its infrastructure backlog.

“The year will be coming when 6.2% will seem like a bargain,” he said. “It seems to happen every generation.”

The budget documents will be reviewed again by county committees and presented, including proposed amendments, for consideration at the Jan. 28 county council meeting.