Council supports 3.2% tax increase in Wellington North

KENILWORTH – Taxpayers in Wellington North will likely see a 3.16 per cent increase in township property taxes next year.

That’ll be an additional $48 for a typical household in the township (based on provincial property assessments from 2016).

Though the budget has not passed, councillors expressed unanimous support for it during a Dec. 1 council meeting and are set to officially approve it on Dec. 15.

Staff initially proposed a 4.13% increase on Nov. 3, but council instructed them to make some cuts to reduce the impact on taxpayers.

Finance director Jeremiah Idialu presented the revised $24.8-million budget to council.

[related]

The 2026 tax levy – the amount of tax revenue required for the total budget – is about 5.72% higher than last year, Idialu told council.

The township’s estimated assessment growth for 2025 is 2.46%, up from the 1.7% estimate provided last month.

Factoring in the assessment growth brings the net tax levy increase to 3.16%.

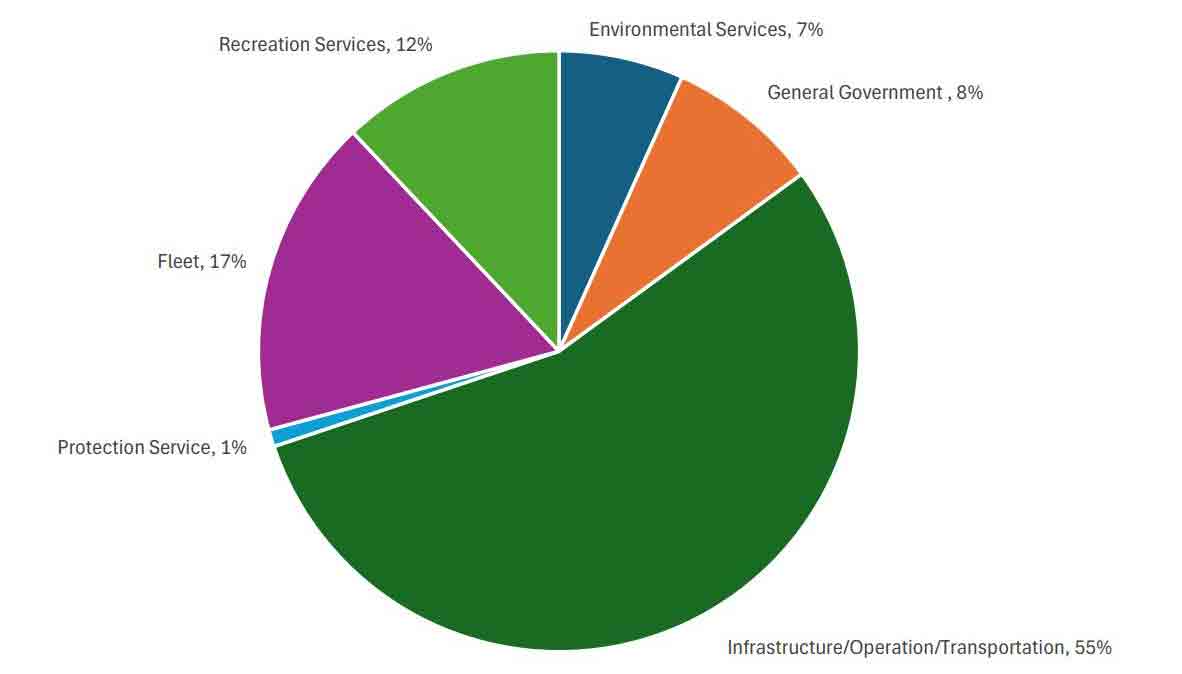

The total budget includes $11.34 million in operating costs, $8.7 million in capital costs, $4.07 million in transfers to reserves and about $690,000 in debt payments.

The capital budget is funded by:

- taxes and user fees ($4.6 million);

- development charges and reserves ($1.4 million);

- Ontario Community Infrastructure funding ($1.4 million);

- debt financing ($1.05 million);

- gas tax utilization ($159,000); and

- developer contributions (about $50,000 expected).

Township staff reduced capital costs by about $422,000 since the November meeting to bring the tax levy increase down.

This included splitting the work on the Arthur office parking lot over two years to defer some of its cost to the 2027 budget, decreased prices for a new backhoe and road grader, and postponing three Mount Forest projects: Mount Forest Drive, McPherson Park and cenotaph and cemetery improvements.

Big-ticket items remaining in the capital budget include:

- $2.7 million to reconstruct Clarke Street, between Smith and Walton, in Arthur;

- $1.2 million in rural asphalt resurfacing;

- $790,00 for a new road grader;

- $485,335 for water and wastewater projects in Mount Forest and Arthur;

- $375,150 to demolish the former Sacred Heart Catholic School in Kenilworth;

- $350,000 for the Mount Forest outdoor pool construction levy;

- $275,000 for a new backhoe;

- $250,000 for a new sidewalk trackless tractor;

- $173,800 for IT projects;

- $185,000 for two pick up trucks and an SUV;

- $100,000 for waterman valve and fire hydrant replacement;

- $100,000 for reconstruction design of Cork Street in Mount Forest; and

- $86,300 for Mount Forest Cemetery projects and equipment.

Councillor Sherry Burke asked if it was too soon to demolish the former Kenilworth school, as there has been discussion about collecting public input to determine what the building or land should be used for.

“I do realize these dollars are coming from reserves ... [but] I would much rather see those dollars be used to facilitate [a public consultation] process,” said Burke.

Councillors Steve McCabe and Penny Renken agreed.

Idialu said funds set aside for demolishing the school were provisionary and could remain in the reserve account if council opted not to proceed with the demolition.

Burke also questioned the need to purchase two trucks and an SUV at once, noting she thought fleet management followed a more staggered approach.

“I’m just wondering if one of those might be able be able to be deferred for another year,” said Burke.

CAO Brooke Lambert said the vehicles were identified through the township’s fleet management policy.

"It’s based just on kilometres, usage and age of the vehicle, so that’s what staff have identified for consideration," she said.

"If council has other thoughts we can take that back and look at it again.”

Council had a lengthy discussion about the Mount Forest cemetery, and opted to postpone paving its entryway for $11,000 to 2027.

Mayor Andy Lennox said he thought the cemetery should recover its own costs in user fees, and asked if the rest of council agreed.

“Under the Municipal Act cemeteries can be fully cost-recovered,” he said.

"They’re not required to be funded from the tax levy. But we continue to fund from the tax levy."

“I’m in favour of moving toward a cost recovery model,” said councillor Lisa Hern

Burke said she would be happy to increase user fees at a nominal rate, but it would take “leaps and bounds” to reach full cost recovery.

So she’s also happy to continue supporting the cemetery with taxes or reserves.

McCabe said while he’s “okay with doing a cost recovery,” he’d also like to see the rates increase over time instead of all at once.

Renken agreed: “Do it gradually so it’s not such a burden on the taxpayers.”

Hern said her biggest frustration with the budget is that property assessments are based on data from 2016.

“The whole premise of taxation is to have it be fair and equitable and I don’t see how we can” without current data, she said.

“Do we have any idea when assessments are going to be done again?”

Idialu said officials with the Municipal Property Assessment Corporation, which assesses properties in Ontario, have noted “probably in the next two years, but ultimately the decision lies with the provincial government.”

“Wow. That’s just ridiculous,” Hern said.

Lennox said unfortunately there was no one in the meeting “with any influence over that.”